Getting My What Is Trade Credit Insurance To Work

Wiki Article

9 Easy Facts About What Is Trade Credit Insurance Described

Table of ContentsFacts About What Is Trade Credit Insurance RevealedRumored Buzz on What Is Trade Credit InsuranceSome Known Questions About What Is Trade Credit Insurance.Unknown Facts About What Is Trade Credit Insurance

This is provided by some trade finance experts covering the potential delays to settlement which could come from cash transfer limitations, or the insolvency of a federal government buyer. Our political risk insurance policy assists companies to secure their abroad investments in circumstances such as political violence or confiscation of properties, or other threats concerning the activities of a foreign government.In some cases it does function out a lot higher than this if there is incomplete credit score history or various other red flags. As with any kind of insurance, there is a computation to be done around risk.

They allot each of those clients a grade that mirrors the health and wellness of their activity and also the method they conduct business. Based upon this danger analysis, each of your purchasers is then approved a particular credit line approximately which you, the insured, can trade and also be able to case ought to something go incorrect.

The Basic Principles Of What Is Trade Credit Insurance

The guarantees will certainly cover trading by domestic firms as well as exporting companies and the intent is for agreements to be in position with insurers by end of this month. The assurance will be short-lived and targeted to cover Covid-19 economic challenges, as well as it will certainly be adhered to by a review of the TCI market to ensure it can best support services in future.It is vital to get the details right to ensure that the plan helps services and also insurers, and also provides value for money for the taxpayer. It is important that insurance firms can keep their underwriting criteria and also take the chance of monitoring techniques, to make certain that assistance is supplied to organizations that can trade out of the existing scenario - What is trade credit insurance.

Offered the unexpected interruption to economic activity, and the enhanced risks of insolvency and default out there, profession credit scores insurance providers may instantly withdraw some of the insurance coverage that they presently provide in order to stay viable. The alternative would certainly be to boost premiums somewhat that is uneconomical for all events.

Profession credit scores insurance plays a specifically significant role in non-service markets, such as production as well as construction, providing services the self-confidence to trade with one another. The Government is keen to make sure that these fields are not put into additional distress as a result of the Covid-19 crisis. This system will make sure that supply chains continue to be safeguarded go to my site from the possible domino impact of trade disturbance and organization defaults.

What Is Trade Credit Insurance Things To Know Before You Get This

The details are still being settled by the UK Federal government and being talked about with insurance companies. The federal government is working with industry to finalise the details of the system.

The Federal government's concern for this plan is to work with insurers to sustain UK services. It is the Government's objective that this scheme will certainly enable the trade credit history market to operate as normal, as much as feasible.

The Best Guide To What Is Trade Credit Insurance

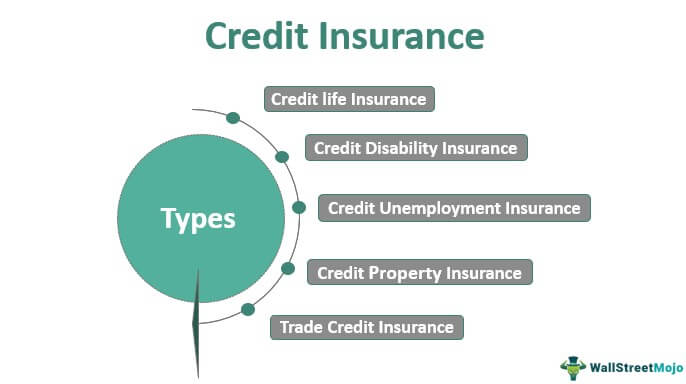

More details of the system will be introduced eventually. The Government's concern for this scheme is to support UK businesses that might be influenced by the withdrawal of trade credit scores insurance policy cover during the Covid-19 situation. In the longer term, it will certainly be suitable to review the see this website effectiveness of this treatment, analyze exactly how the marketplace replied to economic disturbance, and think about how it can remain to ideal offer organizations.While the biggest drivers on the market are abroad companies, this is not a bailout for insurance firms. We are working with the insurance companies to ideal support British companies. Trade credit insurance supplies defense for organizations when customers do not pay their debts owed for products or services. The policy will repay the insurance holder in the occasion of the customer's non-payment, approximately a particular credit line set by the insurance company.

This could intensify the financial influences of the pandemic by causing issues for liquidity and functioning funding for buyers and destructive count on supply chains.

The sales of items and services are exposed to a substantial variety of dangers, most of which are not within the control of the distributor. The highest possible of these dangers and one that can have a tragic influence on the practicality of a supplier, is the failing of a purchaser to spend for the products or services it has actually bought. What is trade credit insurance.

Report this wiki page